5 Smart Financial Moves to Start Saving in Your 20s

There's no denying the fact that your 20s are the most crucial stage of your life. This is the period when you’ll decide your career path and get surrounded by various responsibilities. While embarking on this new journey, however, many people tend to make one critical financial mistake, i.e., only thinking about saving money but not acting on it.

As tempting as the idea of going out and enjoying life may sound, it’s important to understand that the savings that you start in your 20s will help you achieve your financial goals more easily. Not to mention, the earlier you start saving money, the more money you’ll have.

But, what’s the right way to save money? How much money should you put out in your savings fund every month? These are a few questions that every person in their early 20s struggles to answer. So, in this guide, we are going to share 3 smart financial tips from industry experts for everyone in their 20s that’ll help them sail in the right direction.

1. Start Small

The mistakes most people do is think they don’t earn enough to save but in reality, even if you start small but save consistently, you can build a secure future in the long-term.

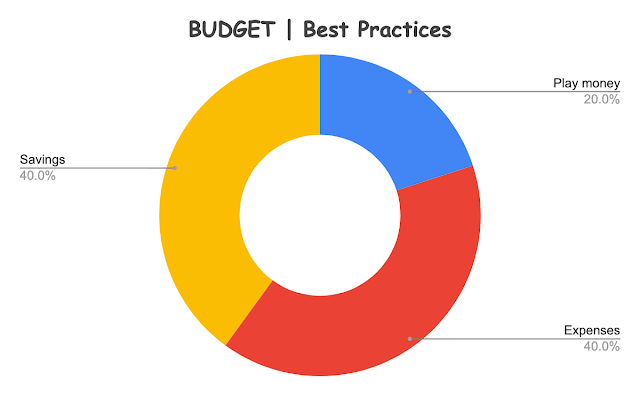

2. Set Threshold/Limit

You can never start saving until you set a limit to your spending. A few neo zero balance account mobile apps such as MoneyHop, PocketGuard and Stash can help you set budgets for the month ahead so that you achieve your saving targets.

An emergency fund is basically a savings account that’s primarily created to tackle unexpected financial hardships. You can consider the emergency fund as a lifeboat in case of extreme financial emergencies.

Even though almost everyone ends up starting an emergency fund in their life, it would be much better if you take this step in your twenties. Why? Because in case you encounter any unexpected situations in your life, you won’t have to dry your primary savings account.

4. Set up a Global Zero Balance Account

Global zero balance accounts are the new way of saving as you have the ability to use it anywhere in the world, withdraw cash from anywhere in the world and none of the hassles such as minimum balance, hidden charges and archaic process. Currently, only a few banks are doing that in the world, but if you’re in India, then MoneyHop is the best zero balance global account which can help you set budgets, make international money transfers and convert currencies from inr to usd or cad seamlessly.

5. Set Up a Retirement Fund

Like the emergency fund, setting up a dedicated retirement fund is also crucial for people in their 20s. As the name implies, the retirement fund is the account that you use to save money for your post-retirement life. As soon as you get your first full-time job, make sure to open a separate account for your retirement fund and decide on an amount that you can put out every month. Keep in mind that the key to growing your retirement fund is to be consistent.

Conclusion

So, that concludes our guide on how to make smart financial decisions in your 20s. In addition to these tricks, people in their 20s should also use a dedicated banking solution to save more effectively. MoneyHop is one such banking solution that’s specifically tailored for millennials to make smart financial decisions and save money stress-free.

Comments

Post a Comment